Are we on the threshold of another Mexican "moment"?

From The Mexpatriate archive

Welcome to a Sunday edition of The Mexpatriate.

A year ago, Elon Musk confirmed Tesla’s plan to build a “gigafactory” in the state of Nuevo León, expected to generate up to US $15 billion in investment.

While the factory has yet to break ground, the Tesla announcement was one of the biggest business stories in Mexico in 2023, a year dominated by the story of “nearshoring.”

Shortly before the Tesla news broke, I published a post about the excitement—and skepticism—surrounding Mexico’s economic “moment.” I have decided to republish this post today, starting with an update on some relevant economic statistics and news of the last year:

GDP growth

Mexico’s economy grew more than economists predicted in 2023, with annual GDP growth of 3.2%. The strongest growth was in the manufacturing sector (3.5% growth over 2022). The IMF ranked Mexico as the 12th largest economy in the world in 2023.

Foreign direct investment (FDI) and trade

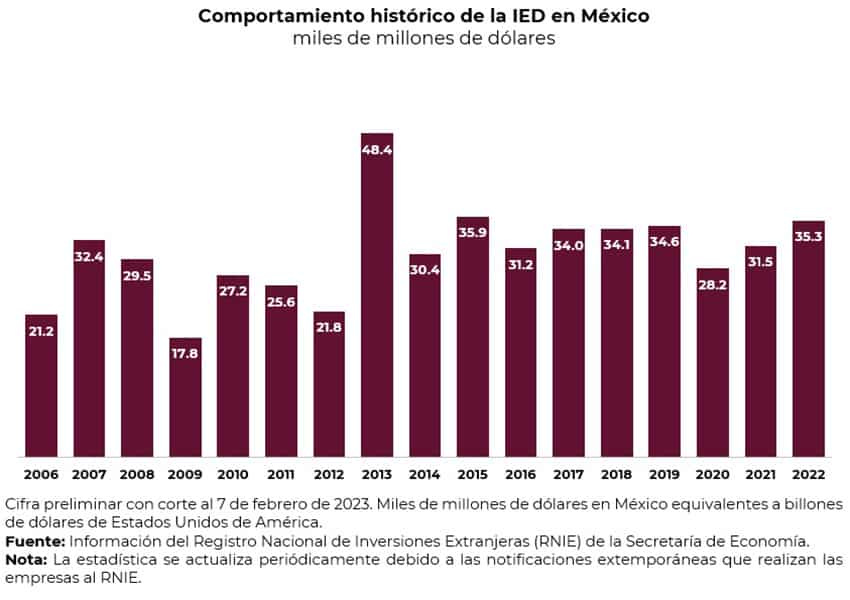

Preliminary data show a total of US $36.06 billion in FDI for 2023, 2.2% higher than the year before, but below figures projected by some economists. Only 13% of the FDI recorded in 2023 was new investment, however, the Economy Department (SE) reported that US $106 billion of FDI announcements had been made in the first 11 months of the year, and last week that investments worth US $25.84 billion had been announced so far in 2024. Mexico’s export revenue reached a record high of US $593 billion in 2023, and Mexico ousted China as the top exporter to the United States and also its largest overall trade partner.

Growth in the south

In September last year, the Bank of Mexico reported that Mexico’s southern states grew faster (6% annual growth in Q2) than those in the more industrialized central and northern regions, driven mostly by public and private construction projects.

Poverty reduction

Between 2020 and 2022, the number of Mexicans living in poverty declined by 8.9 million, from 43.9% to 36.3% according to a government development report published in August. This achievement (one that López Obrador has said is his government’s most significant) has been attributed to increasing the minimum wage, expanding social programs and a strong inflow of remittances. However, the report found that only 27% of Mexicans fall in the category of “not poor” and “not vulnerable”—based on lack of access to basic services like education, health care, housing, etc.

Category 1 aviation safety rating restored

After over two years, the FAA restored Mexico to Category 1 status for aviation safety in September 2023. The downgrading to Category 2 had been viewed as a potential obstacle to increased foreign investment and development in Mexico, since it precluded Mexican airlines from adding new routes to the United States.

More Chinese investment

As the U.S.-China trade war continues, news of Chinese companies investing in Mexico has continued to accelerate. According to one analysis, these investment announcements totaled US $8.14 billion from January-November 2023, which would make China the second-largest source of FDI in Mexico after the United States. Meanwhile, in December, the U.S. and Mexico agreed to joint foreign investment screening in a Memorandum of Intent that noted “the critical role of effective investment review mechanisms in addressing national security risks that can arise from certain foreign investment.”

Published originally on Feb. 21, 2023

From the “Mexican miracle” to Mexico’s “moment”?

“Poor Mexico, so far from God, and so close to the United States.”

—Porfirio Díaz (seven times Mexico’s president, from 1876-1911)

This week, I decided to take an aerial view of the current Mexican political and economic scene, and its undisputed, loquacious prime mover: Andrés Manuel López Obrador. But rather than looking at him in his natural habitat of domestic politics, I place him in an international and historical setting.

Mexico’s true “arrival” on the global stage has been announced at several points in recent history by global observers (and former presidents). While AMLO is no darling of the international press, his country finds itself today at the intersection of geopolitical trends of economic nationalism and energy volatility that have brought renewed attention to Mexico’s economy. Has another Mexican “moment” arrived?

As a charismatic political figure, Andrés Manuel López Obrador commands the national narrative; not only by telling his hero’s journey as leader of the “cuarta transformación”, but also by goading his critics to respond to a continuous stream of commentary, gaffes and medias verdades. This can obscure the fact that in some ways, his presidency has been stymied—or distracted—from its domestic ambitions by international events. A pandemic doesn’t come along every sexenio. Nor does war in Europe or seismic shifts in global supply chains.

On Feb. 3, the New York Times published an article titled “Why Chinese companies are investing billions in Mexico”, which through the story of one of China’s largest furniture manufacturers and its US $300 million investment in a factory in Nuevo León, paints the broader picture of “nearshoring”—the biggest business buzzword in Mexico. As trade tensions have mounted between the U.S. and China, and logistics have become costlier since the pandemic-induced supply chain upsets, some businesses see Mexico as a viable option for relocating their manufacturing. The principle reason is Mexico’s proximity to and trade pact with the world’s largest market.

At the North American Leaders’ Summit (NALS) last month, a 12-person committee dedicated to growth of regional self-sufficiency was established, and shortly after, the Foreign Affairs Secretary, Marcelo Ebrard, announced intentions of North America substituting 25% of Asian imports—though he didn’t provide a timeline for this ambitious endeavor.

But do the promises of nearshoring hold up to scrutiny? Has the isolationist tabasqueño president stumbled into the oft-heralded Mexican “moment” on the world stage?

In 2022, foreign direct investment (FDI) in Mexico hit its highest point since 2015 at US $35.29 billion according to Mexico’s Economy Department (SE), though it’s worth noting that number is still well below a peak in FDI in 2013 (US $48.4 billion)—of this, 48% was registered as new investments in 2022, and the manufacturing sector accounted for 36% of FDI.

The U.S. continues to be the biggest investor in Mexico (US $15B in 2022), and according to the SE, China comes in as merely the tenth biggest investor. However, economic researchers at the UNAM Center for China-Mexico Studies (Cechimex) have calculated that the amount of Chinese investment is much larger than it seems, since Chinese investors often use U.S. subsidiaries to funnel capital to Mexico. According to the academics’ estimates, the total amount of Chinese investment in Mexico since 2001 is nearly six times higher than official figures. The NY Times reported in their story that Chinese companies were responsible for 30% of investment in Nuevo León in 2021, second only to the U.S.

This all puts AMLO in an unusual position: his protectionist and nationalist impulse is encountering a favorable regional context shifting away from Asian manufacturing (coupled with Asian interest in better access to the U.S.), but his statist policies clash with private investment interests. His rhetoric and policies reveal a nostalgia for the era of the “Mexican miracle,” a period from roughly 1940-70 characterized by “import substitution” and the nationalization of industries, which did foster growth, but also saw a decline in foreign investment.

“Mexico, for example, which had practiced import substitution for decades — resulting inter alia in closed markets, slow growth, expensive and poor-quality consumer goods, and uncompetitive industrial exports — largely abandoned it in the mid-1980s,” wrote David A. Gantz, a trade and international economics professor in a brief on the NALS for the Baker Institute of Public Policy.

AMLO’s policies have also been explicitly south-facing, which he sees as a critical contrast from his predecessors. Some of this administration’s most significant infrastructure projects are based in the south, including the Tren Maya (Yucatán peninsula) and the Dos Bocas refinery (Tabasco). And yet, the flurry of nearshoring-related investment activity is almost exclusively destined for the northern manufacturing hubs: of production relocation investments in 2022 (based on data from the CBRE real estate firm), 50% was captured by the state of Nuevo León, and only one southern state (Yucatán at 8%) made the list. Just yesterday, AMLO floated the southeast as a possible destination for Tesla’s rumored manufacturing plant investment in Mexico, citing concerns about lack of water in the arid north; but the states of Nuevo León and Hidalgo have been reported as the most likely candidates.

Earlier forecasts of Mexico’s full arrival on the global economic scene were mostly focused on the country’s modernization and efforts to join the developed world. In the 1960s-70s, this meant the construction of infrastructure: public transportation (the CDMX Metro in 1969 for example), highways, universities and other public works. President Luis Echeverría (1970-76) oversaw an enviable 6% annual growth in GDP, though the country experienced an economic crisis at the end of his term leading to a peso devaluation.

All eyes turned to Mexico for the Olympics in 1968, but instead of a victorious moment, it became one of the darkest in recent history when student protesters were massacred at Tlatelolco. A shadow has fallen across each of these perceived opportunities for Mexican glory ever since: for Carlos Salinas, it would come in the shape of the Zapatistas in Chiapas, for Peña Nieto, in the Ayotzinapa atrocity in Guerrero.

The presidency of Carlos Salinas de Gortari (1988-1994) marks the beginning of Mexico’s ongoing encounter with globalization. Salinas opened up Mexico to more private investment, more trade and in the opinion of AMLO and his adherents, to more exploitation—undercutting Mexican farmers and workers, threatening national sovereignty.

U.S. exports to Mexico increased by 517% from 1993 (pre-NAFTA) to now; today, 40% of Mexico’s GDP is dependent on the U.S., through exports, remittances and investment. As written in a January 1995 story in The Washington Post: “The Mexican economy, once closed, has been thrown open to the world…For many Americans, the image of the siesta-taking villager has been replaced by that of the pin-striped businessman barking orders into a cellular phone.”

While Salinas was seen abroad as the champion for Mexico as a land of opportunity, his rise to power began on shaky ground. The 1989 election showed the cracks in the PRI monolith and allowed for a democratic opposition movement to strengthen. His last year in office was a catastrophic one for the country, bookmarked by the Zapatista uprising and the peso devaluation (shortly after his successor, Ernesto Zedillo, was sworn in), with the assassination of presidential candidate Luis Donaldo Colosio in between.

Fast forward to 2012: Mexico has now had its first “alternancia” in 70 years, with the opposition PAN (National Action Party) beating the PRI in 2000 (President Vicente Fox), and then again in 2006 (President Felipe Calderón). In economic terms, both Fox and Calderón carried on broadly with the liberalization strategy initiated under Salinas, representing the “pro-business” PAN.

And then, with the election of Enrique Peña Nieto in 2012, the PRI returned to power. But unlike the priistas of the 20th century, EPN presented himself as a reformer who would tie up the loose ends of privatization in the energy and telecommunications sectors.

In a 2012 article titled “Mexico’s Moment” in The Economist, Peña Nieto declared: “Competition in key economic sectors needs to become a reality. Therefore, establishing policies that foster competition in all sectors will be imperative.” He cited economic experts forecasting Mexico would become one of the ten largest economies in the world by 2020 (it ranks 15th today). Peña Nieto also made the cover of Time magazine in 2014 as the man “saving Mexico”, which the internet will never let him live down.

While Peña Nieto’s administration did manage to get some sweeping energy and telecommunications reform legislation through Congress, and FDI accelerated in response, one of the defining events of EPN’s sexenio was far removed from the halls of Congress and the hubs of industry: the disappearance of 43 students from the Ayotzinapa teaching college in Guerrero in September 2014. The protests that ensued engulfed the country, and laid bare the nexus of the drug trade, politics and law enforcement. Mexico’s “moment” was again muddied.

Today, the world’s geopolitical realignment has indeed reminded everyone about Mexico’s assets—mostly its relationship to the U.S.—echoing the excitement of years past. And yet, while wondering if AMLO’s policies will allow for this influx of investment to flourish, it is equally important to recall the intractable issues that lie beneath.

If we are to learn anything from recent history, it is that the underdevelopment of vast swathes of the country—profoundly lacking in access to education, healthcare, and security—cannot be wished away, whether by glossy magazine covers, or the pontifications of a leader once dubbed the “tropical Messiah.”

Good thing you re-published this post! I particularly enjoyed how you used historical events to provide context for the current situation. Mexico has a long history of missing golden opportunities (or should I say "Mexican Moments") due to political mismanagement and corruption. It remains to be seen whether history will repeat itself this time around.

Looking forward for your next posts!