"I think people in Mexico are very resilient"

A conversation about fintech, digitalization and the mood in Mexico's business community with Damian Fraser

Welcome to The Mexpatriate.

Damian Fraser is the founder and CEO of Miranda Partners, an investor relations, corporate communications and public affairs firm in Mexico City (prior to that, he was the managing director of UBS in Mexico) and is co-host of the MexMoves podcast. He’s also been a valued subscriber to this newsletter almost since the beginning.

I met with Damian last week to discuss the current fintech and banking landscape in Mexico, as well as the broader economic outlook from the perspective of the business community.

Since our conversation, INEGI published data on Q1 GDP growth that was less bleak than anticipated, reporting 0.2% growth. On May 2, President Sheinbaum confirmed the “very good news” that Mexican auto parts will be exempt from the 25% tariffs that went into effect for some auto parts imported into the United States—the USMCA lives to fight another day.

Next week, Sheinbaum will inaugurate the 88th annual convention of the Mexican Banking Association (ABM) in Nayarit, which will focus on financial inclusion and digitalization. As you’ll learn below, these are some of the biggest long-standing hurdles faced by the Mexican economy.

Can you describe the fintech landscape in Mexico today, and what you think will be the biggest change in this sector in 2025?

DF: You can divide the fintech space here into a few categories.

First, you have the traditional banks with fintech arms, like Banorte or Banregio. Then there are the big, well-capitalized fintech companies like Mercado Pago, which is part of Mercado Libre, and Nubank. You also have Story, Klar, and a whole set of niche fintechs—apparently around 600 or so—most of which we haven't heard of, each focused on very specific offerings.

As of now, I think it’s fair to say the only successful fintech in Mexico is Mercado Pago. We don’t have full Mexico-specific numbers since they report globally, but it seems highly profitable. Why? Because it’s integrated into Mercado Libre, and it generates about 95% of its revenue through its marketplace.

Nu has lost a lot of money in Mexico so far. Its margins don’t look good—net interest margins are negative or close to it. They're not making money at the unit or corporate level, but they keep investing.

They have 10 million clients, which is impressive, but you know if I stood on Insurgentes handing out free tomatoes, I’d also have 10 million clients! A sustainable business needs solid economics—you need to sell your product for more than it costs to deliver it.

I’m a happy client of Nu myself; the rates are attractive—13% to 15%. But if your competitors, like BBVA, are funding at 3%, that puts you at a serious disadvantage. They argue that their operating costs are lower, but that hasn't shown up in the numbers. Their scale also isn’t translating into profitability yet.

Their default rates, if you look at the non-performing portfolio at any given moment, are at 7%–8%. But if you factor back in write-offs over the past 12 months, around 20%–25% of the portfolio hasn’t been repaid. Even with triple-digit interest rates, they’re still losing about a quarter of the portfolio. And they have operating costs on top of that.

Nu just announced today that they've officially received their banking license—it'll take another six months or so to be finalized. They’re clearly here for the long run and are willing to keep losing money for now, and I do think they’ll eventually be successful.

One that is doing well and is interesting is Plata card. Most of their top executives are from a top Russian think tank, and after the war in Ukraine started, they came to Mexico. They've just raised around US $160 million at a US $1.5 billion valuation, and they’ve also been granted a bank license. Their success comes down to high-quality engineering, smart use of social media for customer acquisition, and very good underwriting standards powered by data tools.

Plata does something unique: instead of sending the card by post, they send an “ambassador” to your house. That person basically checks you out, verifies that you exist. Mexico has a very high first-month default rate—many borrowers don’t even exist or they never intended to repay—so with Plata’s approach that’s more difficult.

I think the challenge here in Mexico is cash, and it’s also trust. Many people are still nervous about holding their money digitally.

The problem right now, is it feels like there are too many fintechs offering the same credit card product. And they’re competing with traditional banks. The fintechs try to win on user experience—great apps, instant notifications, no commissions. And it’s easier to get the card, you don’t have to go to a bank branch. But underwriting is a challenge. By definition, if someone is getting a card from a fintech, it's either because traditional banks wouldn't give them one or because they already have one and want more credit, which increases risk.

So, I think we’ll likely see some consolidation. In Brazil, Argentina, and Colombia, each one has two or three profitable homegrown fintechs. In Mexico, there’s not a single one—yet.

I think the challenge here in Mexico is cash, and it’s also trust. Many people are still nervous about holding their money digitally. A large share of the population prefers to use cash to avoid taxes or because they’re in the informal economy. Around 80%–85% of transactions under 10,000 pesos are still done in cash—much higher than in Brazil or Colombia for example.

There's also a lot of delinquency and fraud—which can be due to job loss and economic volatility. And because the economy isn’t that digital, there’s less data on people. There’s very little credit history available, so fintechs rely on non-conventional data: if you have an iPhone you get better credit, they check your geolocation to see if you live in a good neighborhood, if you type too fast or too slow, what time of day you request credit, and so on. But these methods have limitations.

So you’ve got the dominance of cash, the informal economy, the difficulty of issuing credit, and a government that wasn’t interested in digitalizing. Social program transfers could have been a tool to digitalize the economy, but they didn’t go that route in the previous administration. AMLO, who’s a political genius, might have avoided pushing digitalization because it increases transparency, and accountability—and a lot of the informal economy is the heart of the Morena party.

But it’s a missed opportunity. There’s this new digital agency now under Sheinbaum and if they can really focus on this, they can boost tax collection without raising tax rates. There are also studies by economists like Santiago Levy that have shown that Mexico's productivity gap stems from informality. McKinsey’s “Two Mexicos” report made the same point: formal, digitalized companies saw strong productivity growth; informal ones did not.

So if Mexico can crack down on informality through digitalizing, it would improve tax revenues, boost productivity, and it would also help fintechs.

Right now, they’re fighting an uphill battle.

How do you think the traditional banks are adapting to keep up with the arrival of neobanks?

DF: The failure of Bineo [Banorte’s fintech] makes it clear that today, it doesn’t make sense to run a separate fintech business outside of your core banking operations. That may have made sense eight years ago, but now your core banking operation needs to be fully digitized. Once that's done, the question becomes: what’s the purpose of the separate fintech? You can instead create different segments within the core bank product to target different customer groups—whether they're younger, older, wealthier, etc.

BBVA got that right. They went all in on digitalizing their core product, and it's working. They’re gaining market share and posting record profits.

Banorte went the other way, launching Bineo as a separate fintech. But by the time they got it off the ground—January 2024—it was too late. Big players like Nu, Story, and Klar were already established, and traditional banks were already more digitalized.

Bineo didn’t have a clear value proposition. Plus, Banorte already had a stake in RappiCard, which is relevant because in banking, around three-quarters of profits come from credit—and credit cards are the easiest starting point. RappiCard was 56% owned by Banorte, and now it's fully owned by them, with its own infrastructure and fintech model.

What is your sense of the mood in the Mexican business community right now?

DF: I think people in Mexico are very resilient, they’re not in panic mode. I’d say there was more pessimism back in early February. At that point, it looked like Mexico was being singled out with tariffs—alongside Canada and China—allegedly due to fentanyl and immigration concerns.

Some of our clients at Miranda have told us they’ve had more meetings with the Sheinbaum government in one month than they had in six years under AMLO.

But since so-called “Liberation Day,” Mexico has actually found itself in a relatively stronger position. There’s a sense now that once the dust settles—if it settles—Mexico could be in a relatively advantageous position, maintaining lower tariffs and with the USMCA in one way or another still intact.

Also, Sheinbaum seems much more receptive to the business community. For example, there’s Altagracia Gómez’s business council that meets regularly to discuss economic priorities.

Some of our clients at Miranda have told us they’ve had more meetings with the Sheinbaum government in one month than they had in six years under AMLO. It feels more open and more engaged. And Sheinbaum has also managed her relationship with Trump fairly well.

I think Plan C, the constitutional reforms, especially the judicial reform—which really caused panic between July and December last year—has now been somewhat accepted, and priced in. People are just kind of saying, “it is what it is.”

Independent agencies like Cofece and IFT will now move into the executive branch. For some businesses, that may not even be a bad thing. Some didn’t like the regulators, so now, they can just talk to the Ministry of Economy and get it resolved more easily.

Growth expectations are definitely down. But that was coming, the government had to cut spending to rein in the deficit. So we’re seeing a significant fiscal adjustment. Combine that with the judicial reform’s impact on investor confidence, Trump’s unpredictability, and a slowing U.S. economy—if Mexico has positive growth at all this year, people would be pleased.

And yet, the peso has strengthened recently, in part because the dollar has weakened more broadly. The Mexican stock market has also performed well over the past month, following a rough 2024. So the overall mood in the business community is relatively resilient, kind of a “wait and see” attitude—let’s see what Trump does, what Sheinbaum does post-judicial elections.

It’s going to take time for things to settle. Turnout for the judicial election will definitely be low, I don’t think anyone’s expecting much legitimacy, but the concerns now are more about the quality of the judges—will they be corrupt? Will they be partisan? Will they just be incompetent? It’s probably going to be a mix of all three.

The thing is that most large businesses don’t spend much time in court anymore—arbitration clauses are standard in contracts now. There's been a kind of privatization of the legal system, moving out of the courts to arbiters. The biggest change could be for companies doing business with the government, especially in sectors like energy. If contracts go south and they can’t recoup their investment, that’s where arbitration—often outside of Mexico—becomes critical.

Regardless, this reform is a big step back, it translates into less investment, less growth. It’s a huge “own goal.”

Whether Sheinbaum really believed this reform was good for Mexico or just didn’t think she could take on AMLO over it, it’s hard to know for sure, but I’d guess she does. I’ve spoken to people around her, and even privately, I’ve heard them genuinely defend the reform. They believe the judiciary is deeply corrupt and beholden to elite interests. From their perspective, a judiciary aligned with Morena is a judiciary aligned with “the people.” So they don’t see that as a bad thing.

What do you see as the country’s biggest potential opportunities in the new global (dis)order?

DF: There’s a huge opportunity—if the U.S. discriminates against the rest of the world except for Mexico and Canada.

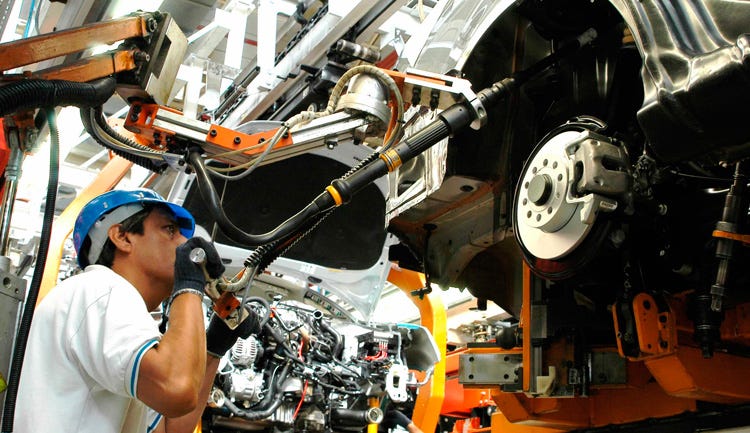

Products that require a lot of labor and were made before in China or Vietnam could shift here. Mexico is of course significantly cheaper than the U.S. for labor, seven or eight times cheaper, once you factor in benefits. And the U.S. is basically at full employment. So even if just 10% of that manufacturing from Asia moves to Mexico, it’s a boom.

But it’s important to note: this isn’t a zero-sum game. Mexico can be better off than other countries, and still be worse off than before if the global economy slows down.

Also, since the first Trump administration, with the increased tariffs on China, Mexico has become a sort of backdoor for Chinese exports to the U.S. That includes re-assembly in Mexico before re-exporting. But now, with higher scrutiny and tighter enforcement of USMCA rules, that’s becoming more difficult and it will slow down Chinese investment.

Many companies—even U.S. firms like GM and Ford—were importing Chinese components because they weren’t available in Mexico. So it’s all very well the idea of Mexico becoming kind of the “rust belt” of the U.S., but there are still a lot of complications holding back the full benefit of that.

Technology has made this kind of work easier to access, and you have a skilled workforce here that’s much cheaper than in the U.S.—and often more motivated.

The second positive thing for Mexico, in some ways, is that the threat of Trump is pushing the country to do things it arguably should have been doing anyway—most notably, cracking down on drug trafficking and the violence associated with it. So, the fear of tariffs is actually having an impact.

In the absence of domestic checks and balances—like from the judiciary—the new counterweight, ironically, is the U.S. government, particularly on migration and drug trafficking.

The third opportunity Mexico has is demographic. Compared to other countries of similar size, it’s in a sweet spot: most of the population is between 18 and 65, so the dependency ratio is low. In other words, a large portion of the population is working.

Meanwhile, there’s a labor shortage in the U.S., which is only getting worse now that undocumented migration is more or less blocked. If you can’t hire Mexican workers to pick tomatoes in California, where will you get those tomatoes from? Mexico. You’re basically shifting the work from California to Mexico.

I have a friend who works in agriculture in California, and in certain areas, 90% of the workers are undocumented Mexicans. If they’re kicked out, more agriculture has to move south of the border. You simply can’t get Americans to do this work profitably. If you’re paying US $25 an hour—which is probably what it would take to attract legal American labor—there’s no margin left. And no president wants food prices to jump 30%, so there’s going to have to be a big shift.

I think nearshoring in services could also be really good for Mexico.

I spoke to a guy recently named Bismarck Lepe—he’s a successful Mexican entrepreneur in the U.S. His family comes from a poor agricultural background and he’s created this telemedicine app for Mexican Americans, where doctors based in Mexico offer medical advice. It’s the first stop between having a medical issue and going to the hospital, and it costs about 80% less than what U.S. insurers charge. And they’re hiring thousands of doctors in Mexico.

Companies like KPMG are also involved in higher-end outsourcing, of engineers and others for U.S. companies. Technology has made this kind of work easier to access, and you have a skilled workforce here that’s much cheaper than in the U.S.—and often more motivated.

During the Super Bowl this year, six of the ads were filmed here in Mexico City, and they weren’t ads specifically set in Mexico. That’s another form of nearshoring. Labor costs are high in the U.S., and the workforce can be inflexible—you can’t easily work outside 9-to-5 hours. Mexico has more flexibility.

So yes, I think there are many opportunities. People often focus too much on the government, on Trump, or on Claudia. But beneath all that are deeper demographic and technological changes that, in the end, will have more impact.

I’m not denying there aren’t risks and concerns, of course. But Mexico has the luck of geography—being right next to the U.S.—and has a culture that’s very hardworking.

In a way, it’s a very capitalist country. The public sector is so weak and small (only about 25% of GDP is state-run) that the private sector has had to step in and solve problems that governments usually would. Security, education, healthcare—people pay out of pocket or hire private services, if they’re lucky enough. That does create a lot of dynamism.

Thank you for reading and feel free to send me your comments and questions at hola@themexpatriate.com. If you enjoyed this interview, please consider upgrading to a paid subscription below for full access to The Mexpatriate.

Incredibly informative, thanks for posting!