The Mexpat Interview: Ernesto Canales

A data-driven look at trade, investment and technology in Mexico with the co-founder of Latinometrics

Welcome to the March edition of The Mexpat Interview.

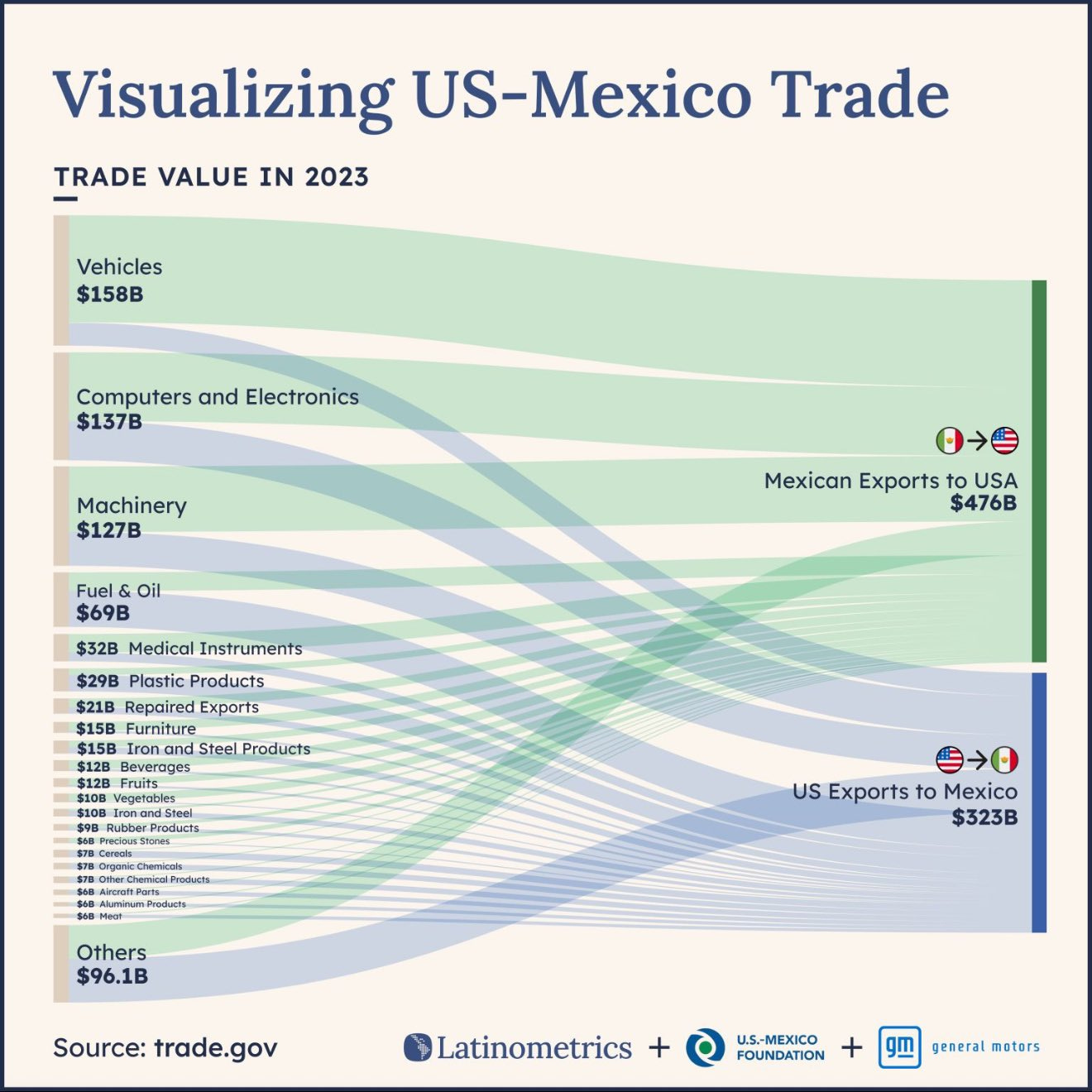

I first came across Latinometrics on X (when it was Twitter), stopped mid-scroll by one of their eye-catching charts. From tracking the shrinking Amazon rainforest to regional trade flows to the expansion of Oxxo, the team at Latinometrics always finds interesting data to visualize.

In our conversation, co-founder Ernesto Canales and I discussed the data he’s watching this year in Mexico, the tensions in the U.S.-Mexico relationship, the country’s economic place in wider Latin America and the impact of technology on the region.

Since our chat, there have been some newsworthy investment announcements for Mexico—Netflix (US $1 billion over four years) and Home Depot (US $1.3 billion over five years)—while trade tensions in the region continue to simmer. The Trump administration’s March 4 deadline for implementation of a 25% tariff on Mexican exports to the U.S. is still hovering, even though the Mexican government offered up a platter of 29 cartel operatives to the U.S. on Thursday, and according to U.S. Treasury Secretary Scott Bessent, also put forward a “very interesting” proposal to match U.S. tariffs on China.

As you’ll learn below, Mexico has room to grow in order to diversify its trade and investment relationships—and while Ernesto is still mostly optimistic about U.S-Mexico economic integration, he also thinks it’s time for the country to broaden its horizons on the world stage.

You cover everything from demographic to business to cultural trends on Latinometrics. What do you think are the most important ones to watch in Mexico in 2025?

EC: One trend I’ve been thinking about a lot is wage levels in Mexico. While it’s important for 2025, it has been significant for a while. Wage stagnation has influenced much of the country's political landscape, contributing to the rise of populist leaders like AMLO and now Claudia Sheinbaum.

Over the past 30 years, average wages in Mexico have remained stagnant, which is shocking for a country that has almost quadrupled its economy’s size in that period. This means that while Mexico's economy is now the 13th biggest globally, and unemployment is at a record low, average workers have not seen those benefits reflected in their paychecks and so they’re demanding higher wages.

This situation has deepened the divide—this big disconnect—between Mexico’s upper class and middle to lower classes, and there’s been a push for stronger safety nets and minimum wage increases. A lot of people commented on the chart we published, saying “wait, I thought they just increased the minimum wage over 100%?” But what we were looking at here is average wages, not the minimum wage, so while those increases are significant, they take time to affect overall wages across the economy. This remains a big area of opportunity for Mexico’s development, to strengthen the middle class.

If you want to stay on top of the national conversation in Mexico, sign up for a paid subscription for full access to The Mexpatriate.

Another key issue that has dominated the headlines—for good reason—is the U.S.-Mexico relationship. We wouldn’t be the country we are without the U.S., this is an inextricable relationship—millions of people’s livelihoods depend on it. A trade war would cause an economic crisis for Mexico, given how many industries rely on the U.S. economy, so the question is what concessions will Mexico need to make to continue having the benefits of the USMCA? The U.S. and Canada also benefit from it of course, but whether it stays or goes will be a defining moment for Mexico’s economy.

While other countries may be de-prioritizing trade relationships, Mexico has an opportunity to do the opposite, and in bringing in more investment as well. Brazil, for instance, attracts almost twice as much foreign direct investment (FDI) as Mexico and while it’s bigger, I don’t see any reason why Mexico shouldn't match or exceed Brazil in this regard because of its strategic position. Diversifying trade and investment relationships beyond the U.S. and Canada is crucial for long-term stability.

How do you see Mexico’s economy fitting into the broader regional context in Central and South America?

EC: Mexico’s supply chain, built to serve the world’s largest economy, should position it well to expand trade with other nations. The U.S. imports about 15% of its goods from Mexico, meaning Mexico has a highly diversified industrial base. If Mexican industries can serve the U.S., they can serve any economy in the world. There’s potential for Mexico to not only be a trade partner, but also a competitor to the U.S. in certain markets. But it takes a lot of re-thinking the relationships that make sense for Mexico.

Additionally, Mexico is becoming a more viable competitor to China in manufacturing, as Chinese labor costs have risen above those in Mexico. The question is whether Mexico will seize this opportunity and look south, east, west instead of just north.

There is a tremendous focus on the North American economy and its future as an integrated bloc right now. What data gives you hope for the USMCA and what data causes concern?

EC: I think there are two ways to look this. While about 15% of everything the U.S. buys globally comes from Mexico, we also buy about 13% of U.S. exports. So yes, there’s a trade deficit, in the sense that the U.S. buys more from Mexico than it sells, which is the point that Trump loves to make. But I just can’t see a world where this all gets blown up; with how how much the U.S. generally embraces business interests. So, while I think the tariff threat is intimidating for Mexico, this makes me optimistic.

On the other hand, the U.S. has far more economic resilience than Mexico, with a lot of influence that can be used to its advantage. Mexico is not in the same position. If a trade war were to occur, the U.S. would suffer less pain than Mexico, which lacks the same ability to attract investment and trade alternatives.

Which technological changes do you think will have the biggest impact on Mexico in the next 5-10 years?

EC: Just like everywhere else, I think AI will have an impact on Mexico and could help us be more efficient and offer more services, not just manufactured goods. We should embrace that opportunity. AI could level the playing field for Mexican workers, making them more competitive in global markets. In a way, I think AI could be more impactful in a developing country like Mexico, by giving opportunities that could raise up citizens to the level of those who’ve had more advantages. Our leaders should be thinking about this, about not falling behind.

I also think fintech companies will continue trying to solve the problem of financial inclusion and digital banking in Mexico. I hope that will lead to more formality in the economy, but it seems like no one has been able to crack the code on this here. In 2023, 55% of the adult population had a bank account, which is really falling behind; in most developed countries it’s close to 100%.

The key challenge is creating incentives for digital adoption. Brazil successfully implemented a digital payments program called Pix during the pandemic and because the government invested in this technology, now Pix dominates as the form of payment in the country. So we know it’s possible!

Which dataset about Mexico most surprised you recently?

EC: I was going to say the one about the wage stagnation, I’ve been thinking about it a lot—it’s so shocking to me how we haven’t really been able to grow wages in three decades. But I’d say the fact that FDI in Mexico is around half that of Brazil maybe shocks me more.

As the neighbor and largest trading partner of the United States, Mexico should be attracting more investment, in technology and other sectors. It seems like President Sheinbaum is focusing on this with her Plan México, on attracting more investment—which is a priority I think we need to embrace. Also, while our population was growing quickly for decades, now it’s slowing down, and this is a worry for developing countries since they are less likely to attract immigrants to counter this trend. In order for an economy to continue growing, it needs working-age people. Mexico should be able to attract not just investment, but people who want to work here—which means having better-paying opportunities.

One thing that I think Mexico hasn’t capitalized on is that the world is watching us right now—it’s an opportunity for our leaders to position Mexico intelligently, as a safe place to invest and serve as a hub for global companies looking to operate in Latin America. Mexico’s “brand” is very strong, the country has a lot of soft power, but in order to attract capital, you have to go out and influence the global perception of what the country has to offer.

Do you think President Sheinbaum's goal to make Mexico a leader in technology and science is viable?

EC: I think the message of embracing science and technology is a very good one. Though I don't think historically it has really worked for the government to come in and start its own companies, if it can create partnerships with the private sector and focus on strategic investment, Mexico could position itself as a technological leader in the region.

But as it is now, Mexico invests just 0.3% of its GDP in research and development, far behind countries like India and Brazil, which invest over 1%. Which probably helps explain what I mentioned earlier, about attracting FDI—increasing investment in innovation and education is crucial for Mexico to compete globally.

Thank you for reading and feel free to send me your suggestions, comments and questions at hola@themexpatriate.com. And be sure to check out Latinometrics to stay informed about trends in Mexico and Latin America.